Residential Zoning:

- Allows for full-time living and long-term rentals with no restrictions on personal use.

- Disadvantages include the restriction on short-term rentals and potential management fees for long-term rentals.

Tourist Zoning:

- Offers the most flexibility, allowing for full-time living, long-term rentals, and short-term rentals including nightly or weekly rentals.

- However, obtaining standard mortgage financing can be challenging, and cash-only purchases or commercial mortgage approval may be required.

Visitor Accommodation Zoning:

- Primarily designed for short-term rentals, with the option for part-time living for up to 30 days at a time.

- Offers hotel-style management options but may require cash-only purchasing or commercial mortgage approval.

Employee Housing / Perpetually Affordable Housing (PAH):

- Restricted ownership for residents who work a minimum number of hours per week in the Bow Valley.

- Purchased through the Canmore Community Housing Corporation and may have resale restrictions.

Each zoning type caters to different needs and preferences, whether it’s long-term residence, short-term rentals, or affordable housing options for employees in the area. Property owners need to consider these factors carefully before making any decisions regarding their property in Canmore.

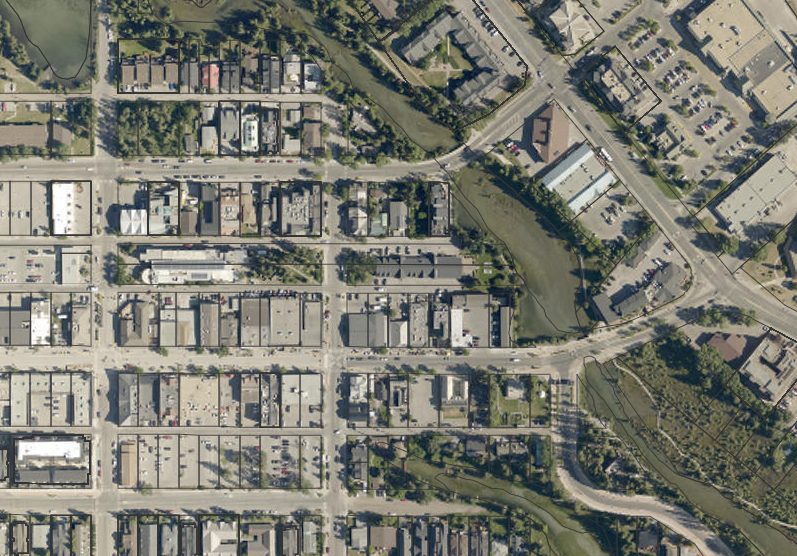

The Property Information Viewer shows the following information:

- Assessed Property Values (for tax assessment purposes)*

- Offsite Levy Zones

- Area Structure & Redevelopment Plans

- Steep Creek Hazard Zones

- Legal Descriptions

- Undermining Areas

- Land Use Districts

- Property Boundaries

- Wildlife Corridors

- Habitat Patches

- Provincial Parks

- Provincial Flood Mapping

- 2017 Aerial Imagery

- Building Code 10 Minute Response Time

*The assessed value as shown is based on the assessment on July 1 of the previous tax year and the physical condition and characteristics of the property as of December 31 of the previous tax year.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link